PRACTICE AREAS

WE DELIVER VALUE THROUGH MANAGEMENT CONSULTING,

BOARD ADVISORY, AND RISK TRAINING PROGRAMS.

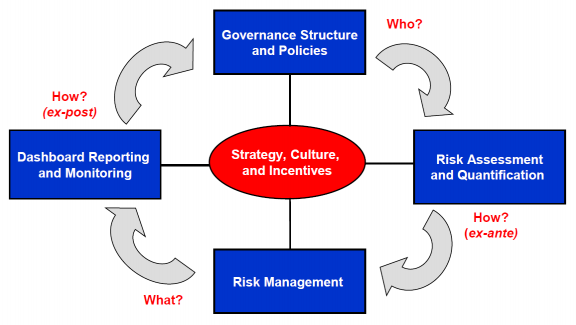

The ERM Framework from JLA

MANAGEMENT CONSULTING

We work with clients across all risk management processes, ranging from establishing an ERM vision and roadmap, to developing risk policies and analytical tools, to designing key risk indicators and dashboard reporting.

Our president, James Lam, leads each engagement. By leveraging the client’s internal staff in the implementation process, our consulting model enhances buy-in, knowledge transfer, and organizational change. James also serves as an executive coach for newly appointed and ascending CROs. He is a faculty member of Carnegie Mellon’s CRO Certification Program.

BOARD ADVISORY

We work with corporate boards in the following areas:

- Formation of risk committees including developing charters, policies, and reports

- Independent assessment of ERM programs to identify key strengths and opportunities for improvement

- Customized board training programs on governance and oversight of strategy and ERM, cybersecurity, and disruptive risks

JLA has partnered with the National Association of Corporate Directors (NACD) to develop in-boardroom and virtual training programs. James is a faculty member of NACD’s foundation and director certification courses.

TRAINING & SPEAKING

We provide customized training programs based on each client’s learning objectives. Key topics include ERM, strategic risk, financial risk, operational risk, and cybersecurity.

In addition to training, James has served as a keynote speaker at industry conferences throughout North America, Europe, and Asia. His story-telling speaking style and first-hand experiences enable him to connect with a wide range of audiences.

COLLABORATION IN THE NEW NORMAL

Business leaders have learned that effective collaboration can occur in virtual and hybrid work environments. JLA has worked successfully with clients in virtual meetings, as well as in safe in-person meetings as appropriate. These client engagements can be established effectively anywhere in the world.

James Lam has been recognized for his leadership in the boardroom, consulting, and the C-Suite

Honored as one of the most influential corporate directors in the NACD Directorship 100

Named by clients and peers in a Euromoney survey as one of the world’s top risk consultants

Received the inaugural Risk Manager of the Year Award from the Global Association of Risk Professionals